Supplier Opinions in Line With Bullish Economy

Wine industry vendors predict prosperous year ahead

Recently, as Chinese stock indexes crashed and trading fluctuated widely in U.S. markets, Wines & Vines conducted its eighth annual survey of wine industry suppliers. Despite the shaky economic indicators from Shanghai to Wall Street, providers of supplies and services to the wine industry reported healthy growth and forecast an even brighter time to come.

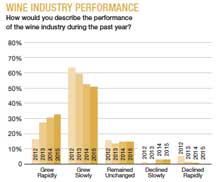

More than 80% of respondents to our survey of suppliers to wineries and vineyards agreed that the wine industry continued its upward trajectory this year, with nearly one-third of all respondents saying the industry “grew rapidly” during the past 12 months.

Jean-Pierre “J-P” Giovanni, vice president and general manager at SGP Packaging-Verallia, said the most growth has come from the premium wine segment, prompting a number of acquisitions by large beverage companies looking to cash in on the growing market for wines priced $20 per bottle and up.

To illustrate his point, Giovanni cited E. & J. Gallo Winery’s purchase of J Vineyards & Winery, a 150,000-case producer known for its sparkling wines, from founder Judy Jordan.

“J was a boutique winery that was doing OK in terms of growth on an annual basis. Now, being owned by Gallo, it will probably be pushed to the Gallo distribution network, which is one of the largest in the world,” Giovanni told Wines & Vines. The exposure will “push it to new distribution channels that J on its own was unable to reach before.”

Giovanni also noted that some existing wineries are working to move their brands from the value or mid-level category into the premium price range, a shift he said would require an overhaul in packaging, branding and marketing.

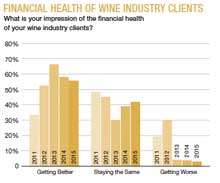

Health of wine industry clients

More than 55% of respondents to Wines & Vines’ 2015 supplier survey noted that their winery and vineyard clients are more financially healthy than in years past.

Trygve Mikkelsen, president of Western Square Industries in Stockton, Calif., said during the past 12 months he’s seen a lot of wineries purchasing new equipment in response to the earthquake that hit south of Napa, Calif., on Aug. 24, 2014. Western Square produces barrel racks, farm gates, harvest bins, trailers and warehouse ladders.

“The earthquake a year ago led to wineries not only upgrading but taking safety seriously and discussing old solutions versus new solutions,” Mikkelsen said.

But the news hasn’t been all bad. “There is lots of optimism in the marketplace,” he added.

Sara Nelson, owner of Sara Nelson Designs of Kennewick, Wash., said many of the individuals currently opening wineries in Washington state have made money in medicine, real estate and other sectors before deciding to enter the wine industry. “They’re doing this now because it’s a passion,” she said. “We’re seeing more well-funded clients.”

Consequently, Nelson’s clients looking to develop branding and packaging materials have the means to produce premium wines that will sell for premium prices. “They’re not doing huge volume, but they are in that top tier,” she said. “I’m seeing a lot of metal labels, a lot of nice finishes, wax dips. Some of those really high-end finishes seem to be a lot more prevalent than they were a few years ago.”

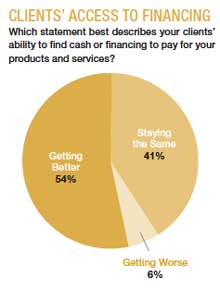

Ability to pay

Nelson wasn’t alone in her assessments. More than 40% of survey respondents reported their clients were better able to get cash and financing this year, and nearly 54% reported no change in the already ample availability of credit. (See “Bankers Optimistic and Ready to Loan” in the September 2015 issue of Wines & Vines.)

“The number of clients in arrears is way down,” reported Phil Burton of Barrel Builders. “Our accounts receivable is about $1.5 million, and our overdue can’t be more than $5,000: It’s a drop in the bucket.”

Burton says that his friends who deal in winery supplies and services report the same trend, and the only companies having trouble attaining credit are serial offenders of non-payment.

“If you hear about one company that didn’t pay for a lot of corks, you think: Maybe they got a bad lot, and they’re not going to pay for them,” he explained. “But when there are six or eight reports like that? They’ve got a cash-flow problem.”

Burton echoed Giovanni and Nelson’s comments about growth in the $20 and up segment, adding that real estate and brand purchases are indicative of strength in the value arena as well. “With all of Gallo’s recent acquisitions, I’m guessing they’re doing OK. They’re in acquisition mode, which speaks well for their sales,” he said.

Speaking of sales, after three large harvests in California, Burton said wineries are buying fewer barrels in 2015 due to yields that are significantly lower than what was recorded during the previous three years. (See “West Coast Harvest Numbers a Mystery” in this issue.)

“We’ve had a couple people ask if they can cut their orders this year. They don’t have the wine for the barrels. I talked to one client yesterday in Paso Robles who thought they were going to get 30,000 cases this year—they would be lucky to get 7,000 or 8,000,” Burton said.

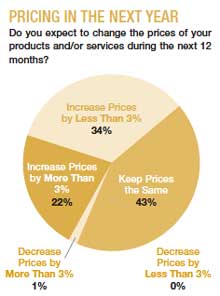

Vendor pricing

As reported in the October 2015 issue of Wines & Vines (see “Oak Sales Stay Strong”), prices for American oak barrels are likely to rise in the coming year due to the spirits industry’s demand for hardwood. Burton reported “surging demand for spirits in Asia and India, particularly bourbon.

“The bourbon makers are snapping up all the available wood, so demand is much higher,” Burton said.

Meanwhile, he added, a favorable exchange rate for the dollar will help mitigate the rising cost of oak barrels from Europe. “They will still be cheaper than they were two years ago.”

Since much of the winery and vineyard products sold by Western Square Industries are made of steel, prices are somewhat tied to the commodities market, and the supplier lowered prices this year as a result.

Mikkelsen said his company will probably have to raise prices after the first of the year, but “it doesn’t happen overnight.” He pointed out that large winery and vineyard customers have become more adept at long-term planning, so they put in orders months before they need them—and before prices increase.

“If the steel prices go up the way we see them, (our prices) would go up again, but it would take three to four months before we see the effect of that decision,” he told Wines & Vines.

Sara Nelson also said that price changes are in store for corporate clients, adding: “Increasing taxes and insurance costs will force us to increase prices.”

Giovanni of SGP Packaging said he hopes the lower cost of fuel will help compensate for increases in other areas of the packaging life cycle. “The wild card will be exchange rates and whether they remain somehow stable after the recent shifts,” he said.

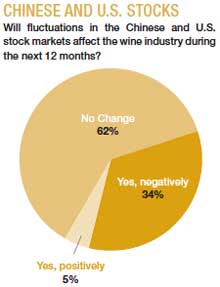

While many analysts have called recent stock market activity a market correction, vineyard and winery equipment suppliers on the West Coast (a major hub for imports from China) were slightly more concerned about volatility in the Chinese stock market, although more than 60% of survey respondents said they expect “no change” to the North American wine industry as a result of such fluctuations.

For suppliers who depend on imports from China to service their wine industry clients, the prospect of a ripple effect in prices or exchange rates will be something to watch in the coming months. A reduction in financial liquidity among the Chinese middle class could decrease demand for wine by beverage consumers in the Far East, while fluctuating currency values may work in favor of U.S. importers.

The year ahead

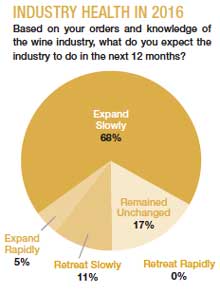

While wine industry suppliers and service providers reported a profitable year with steady growth and prompt payment, respondents to Wines & Vines’ 2015 supplier survey were even more optimistic about the 12 months ahead. Nearly 85% of those surveyed expect to see growth in the wine industry

Sara Nelson says that the process for developing a brand’s story and packaging, getting it approved by the TTB and having collateral materials printed can take the better part of a year. So Nelson’s vantage point is unique in predicting the coming year ahead.

“I don’t think I have any rebrands in the pipeline at the moment. Most of what I am dealing with in 2016 are brand new wineries,” she told Wines & Vines. “I am not seeing a lot of whimsical labels these days. What I am seeing is very grown up. They need to be sophisticated, because if people who are going to drop $40 on wine, they need to be serious.”

|

|

PRINTER-FRIENDLY VERSION » |

|

|

E-MAIL THIS ARTICLE » |